Innovative Solutions to Drive Growth and Security

Tailored strategies designed to meet your unique challenges, empowering your business to thrive and stay ahead in an ever-evolving landscape.

Security

Our Fraud Prevention solution covers the entire prevention cycle with technology developed by experts: from monitoring and deviation detection to strategy selection, impact measurement, and reporting. We combine artificial intelligence models, customized rules, and real-time alerts to detect and respond to fraud with precision, agility, and a strong focus on your business growth.

Regulatory

Our AML compliance solution automates the monitoring and detection of suspicious activities through customized rules, risk matrices, and smart transactional analysis. It integrates international list checks, data cross-referencing, and case creation to ensure regulatory compliance and prevent money laundering in an efficient, scalable, and operation-tailored way.

Revenue

New!

1- Optimization

2- Deep Insights

3- Impact

4- Results

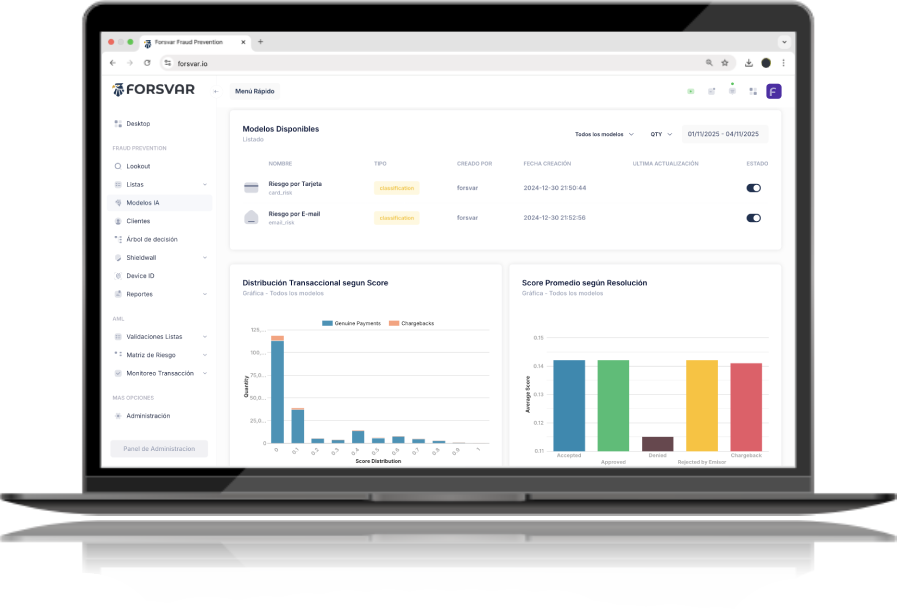

Fraud Prevention

-

Machine Learning at your fingertips

AI models trained by risk experts, designed to detect complex fraud patterns with high precision. We focus on the key features of each business, achieving operational efficiency without compromising conversion or user experience.

-

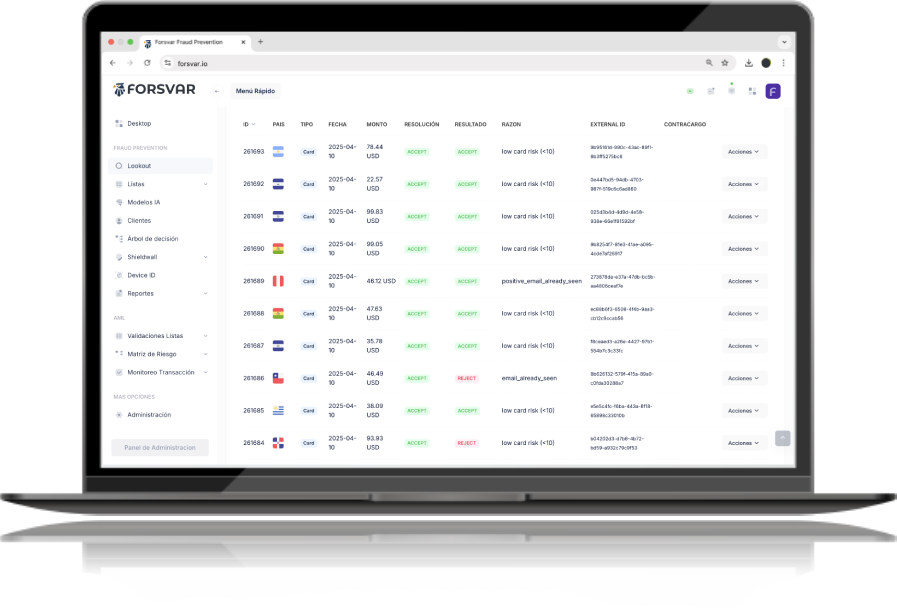

Real-time alerts

Good prevention starts with the ability to react in time. Our alert system detects deviations, anomalies, or threshold breaches and sends real-time notifications, allowing teams to act immediately and proactively mitigate risks.

-

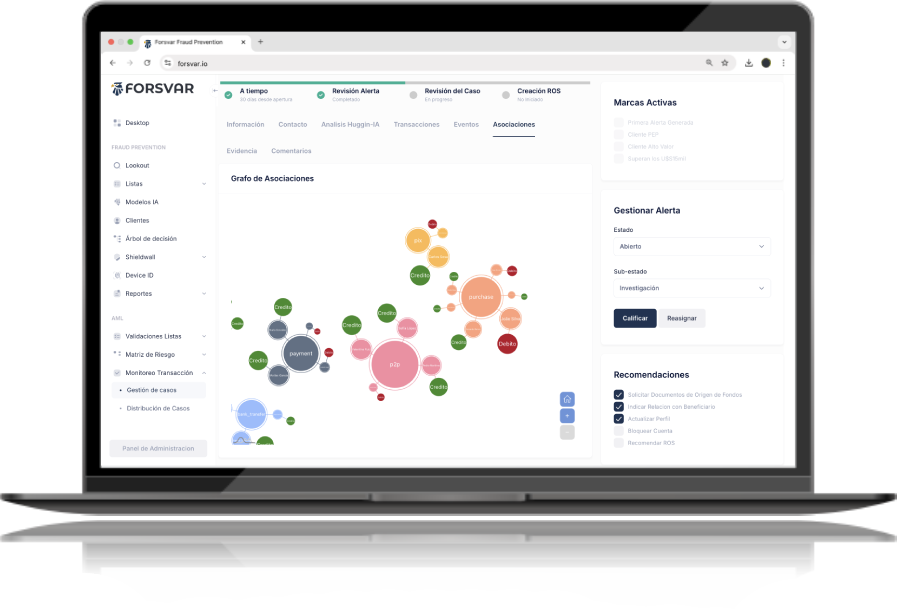

Network Analysis: Uncover complex connections

Not all fraud patterns are obvious. Our network analysis tool allows you to visualize relationships between users through interactive graphs, making it easier to trace money movements and enabling more informed and robust decision-making.

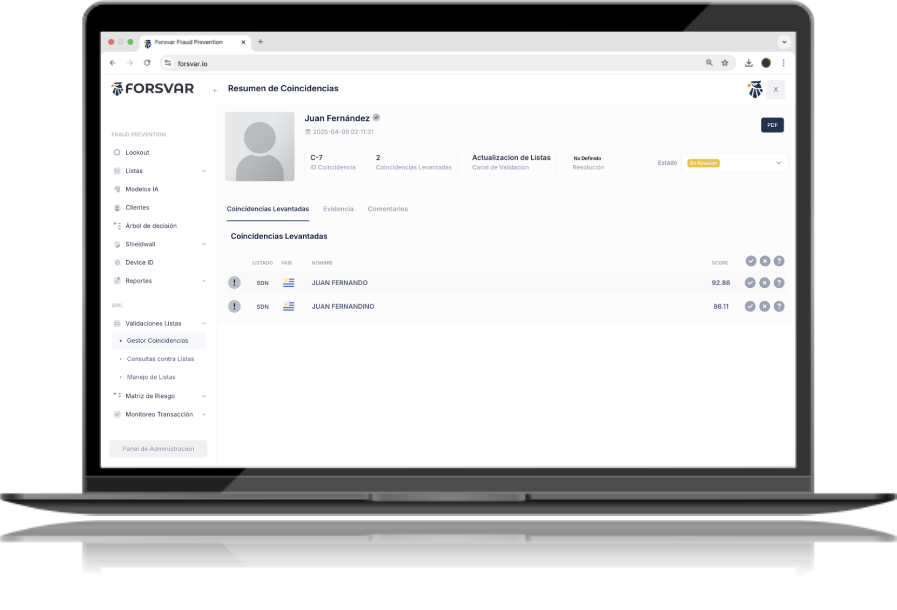

AML Compliance

-

Screening: Redefining speed and precision

Perform automated user screening during onboarding or when they make money transactions, by consulting updated international and local watchlists. Detect sanctioned individuals or entities, politically exposed persons (PEPs), or those involved in illicit activities, and prevent them from accessing your platform.

-

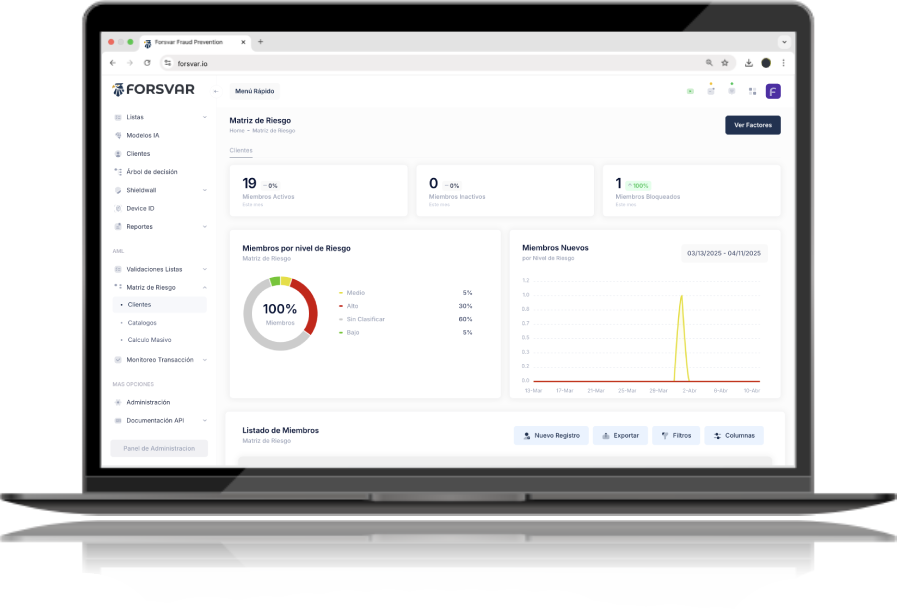

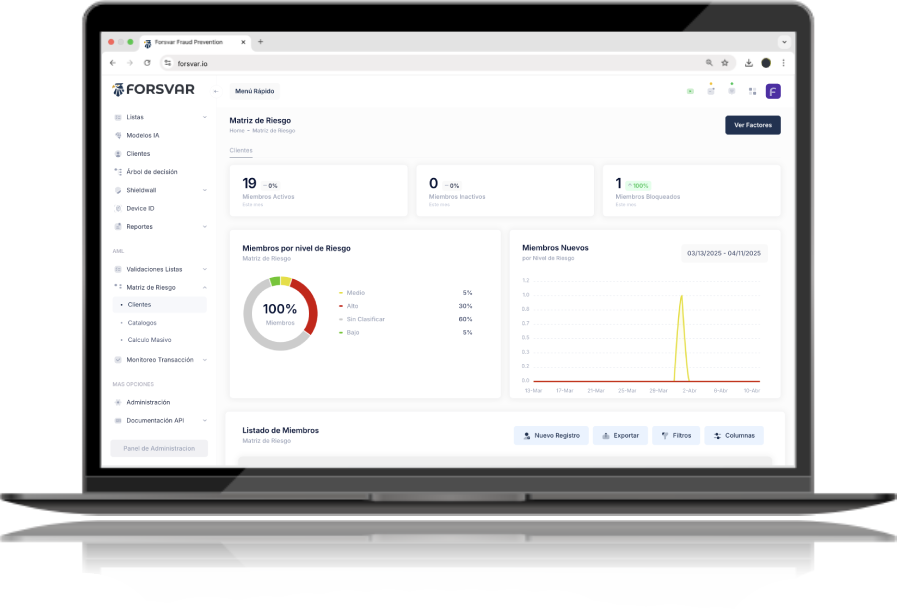

Risk Matrix: Designed for perfect oversight

Configure multiple risk matrices to evaluate your clients based on the factors that best fit your operation. Use as many attributes as you need and assign weightings to segment and classify dynamically according to risk level. No limitations—fully adapted to your compliance strategy and international regulatory standards.

-

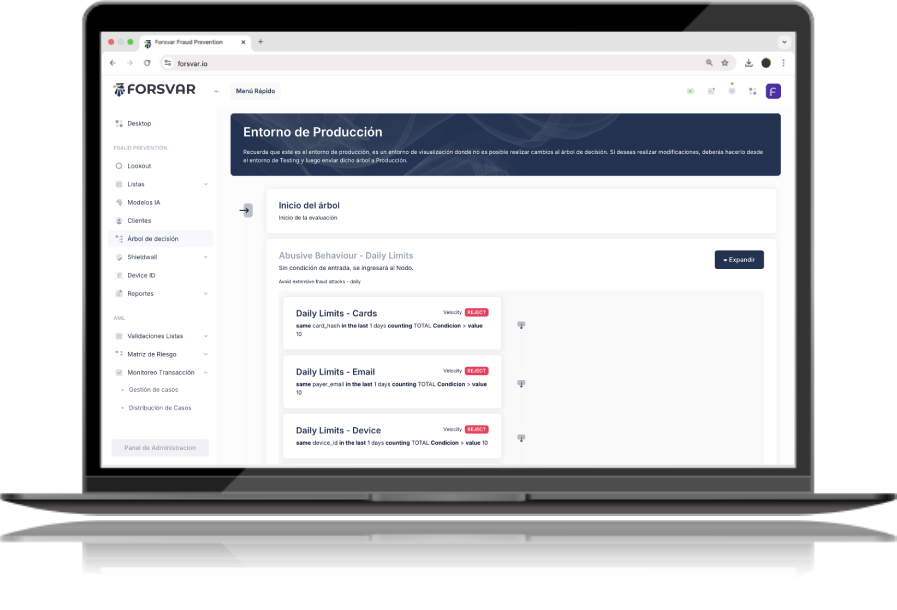

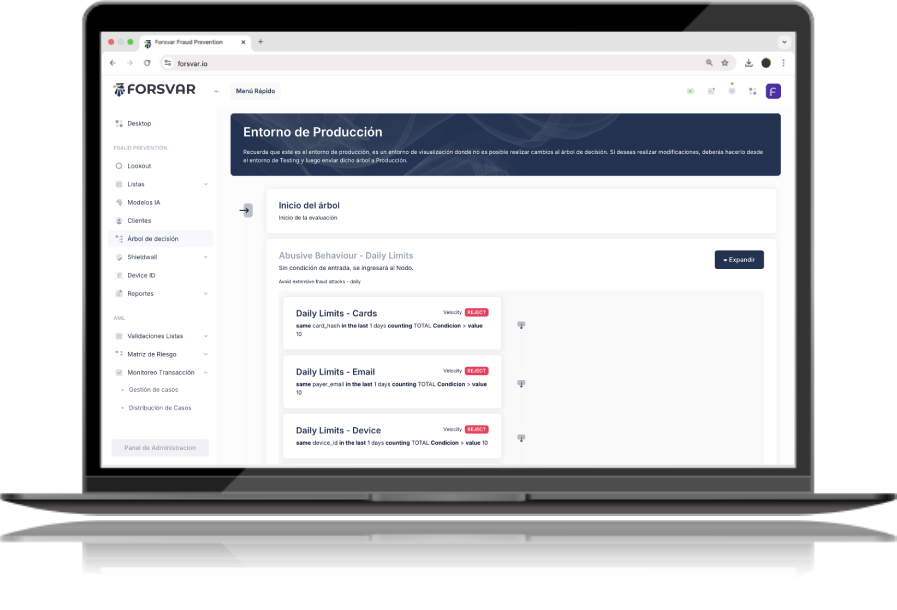

Transactional Monitoring: Protect every payment in real time

Our rule engine, efficient and versatile, allows you to act in real time on any type of event. You can block or approve operations, generate alerts, or forward them for manual review — all based on the rules you configure. Design workflows tailored to your operation with no limitations.

Business Optimization

-

Payment routing

Our intelligent payments routing system ensures that every transaction is directed through the most optimal path. By leveraging advanced algorithms, it minimizes costs, enhances transaction speed, and ensures higher success rates, giving you the edge in payment operations.

-

Track Conversions with Precision

Our Conversion Monitor delivers real-time insights into card payment flows, helping you identify trends, optimize strategies, and boost approval rates. With advanced analytics, you can detect bottlenecks and make data-driven decisions to maximize transaction success.

-

Network Analysis: Your Key to Hidden Insights

Gain full visibility into your operations with intuitive and customizable dashboards. Designed to consolidate key metrics in one place, our dashboards empower you to monitor performance, track KPIs, and uncover actionable insights in real time. Stay informed and make smarter decisions faster, all from a single interface.