Grow faster. We’ve got your risks covered.

Technology designed and developed by experts.

FORSVAR Tech Ecosystem

We provide a 100% cloud-based software solution with integrated features designed to address and automate challenges at every stage of fraud prevention. Powered by artificial intelligence, it offers a streamlined and user-friendly interface that ensures scalability.

One Integration

Our system can process both payments and any type of digital activity events, such as logins or data changes that require risk evaluation, making it a limitless tool.

Real Time Engine

We offer a powerful real-time engine that enables the creation of intelligent rules adaptable to complex fraud patterns, ensuring the ability to turn any conceivable pattern into reality.

Modular System

Our agile architecture allows for modular integration of the solution, enabling you to select only the services you need, optimizing cost efficiency.

We’re Better. Here’s Why…

The system was developed by fraud prevention experts, ensuring that every feature we offer is designed to enhance efficiency and scalability at every stage of the prevention lifecycle.

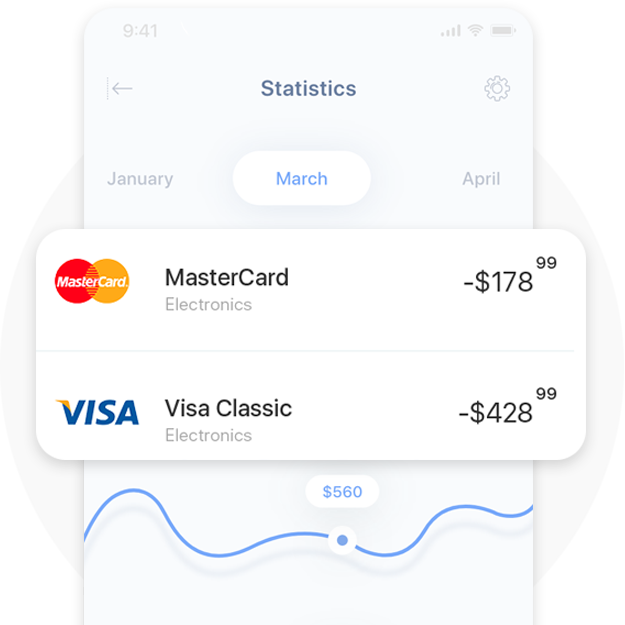

AI-powered credit card risk score

A sophisticated solution that evaluates credit card transaction risk in real-time using advanced machine learning and extensive Latin American transaction data, providing precise and reliable fraud risk scores.

Dynamic Alerts in Real-Time

Real-time alerts provide instant notifications about potential risks or suspicious activities as they happen. This feature is essential for proactively managing fraud, ensuring swift actions, and maintaining secure operations.

AI-powered email risk score

An advanced solution designed to assess the risk associated with email-based activities. It delivers a precise score that identifies the likelihood of fraudulent or malicious behavior, enabling proactive decision-making.

Smart Rule Generator

An advanced algorithm designed to automatically create optimized rules by balancing the trade-off between conversion loss and chargeback capture. Its primary goal is to maximize revenue while ensuring effective fraud prevention.

All-in-One Analytics Dashboards

Our dashboards are designed to provide a complete solution, covering all aspects of transaction monitoring and fraud prevention. From tracking traffic and approval rates to offering detailed insights and follow-ups on chargebacks, our dashboards deliver everything in one place.

Device Fingerprint Technology

Our Device Fingerprint Technology provides advanced capabilities to capture and identify user devices seamlessly. This technology enables precise tracking and profiling of devices interacting with your platform, empowering you with critical insights for risk assessment and fraud prevention.

Your business stays protected, every step of the way.

Our solution ensures security and reliability at every stage of your customer journey. From the very beginning, during onboarding, through data changes, electronic payments, or coupon usage, all the way to fund withdrawals, we safeguard each interaction. With our comprehensive approach, your business can focus on growth while we handle the risks.

Security, Simplicity, Easiness

We focus on ensuring robust protection, seamless integration, and effortless usability for your business at every step.

You will no longer need to be an expert in the tool

Our solution is designed with simplicity and usability in mind, empowering you to maximize its capabilities without the need for extensive technical knowledge. From advanced features to intuitive interfaces, everything is built to ensure efficiency and effectiveness at every stage of fraud prevention.